LAKE MARY, Fla. — A self-proclaimed mortgage expert in Central Florida says it will probably be difficult to hide medical debt despite a rule being finalized by the Biden administration.

The rule would remove medical debt on credit reports and ban leaders from using certain medical information in loan decisions.

The Consumer Financial Protection Bureau reports there’s $49 billion in unpaid medical bills that will be removed from credit reports of 15 million Americans.

Additionally, the agency believes 22,000 additional affordable mortgages will be approved every year once the rule takes effect.

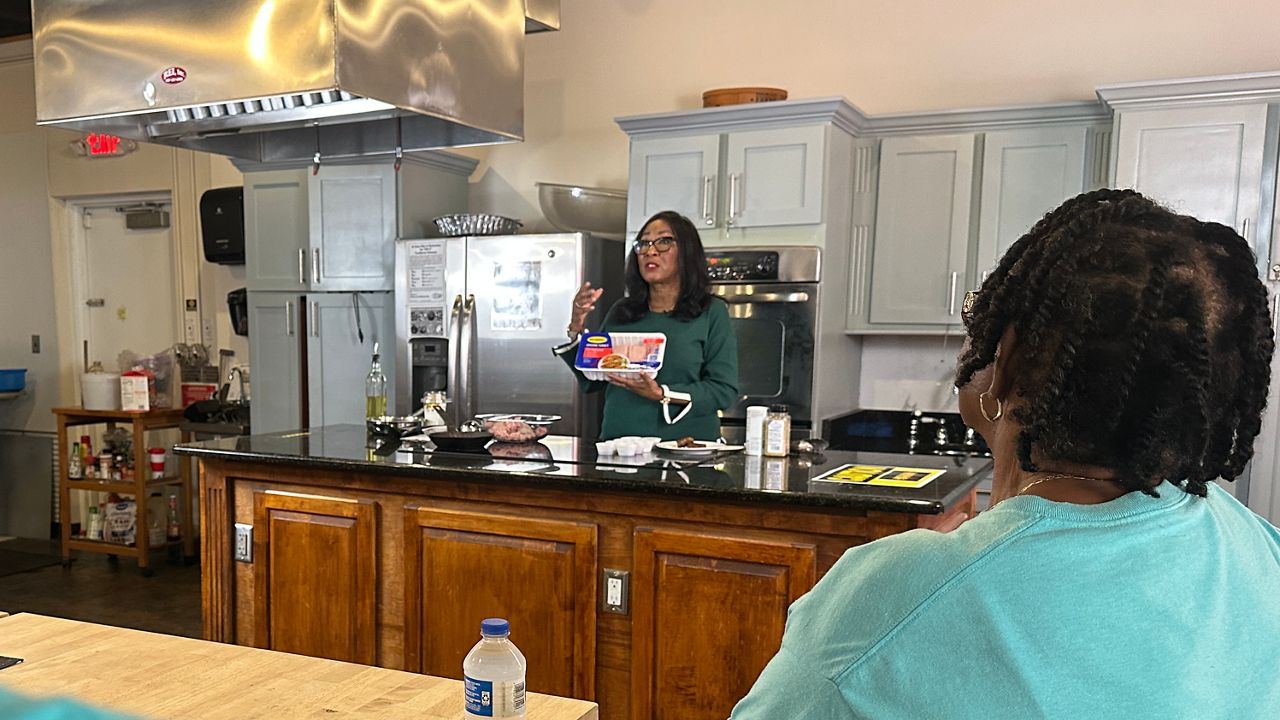

Shahram Sondi, who owns a company called The Mortgage Expert, doesn't buy it, saying that any potential default could come back on the broker involved in the deal.

“Let’s say you have a $10,000 medical bill. We don’t report it on the credit. However, the hospital can sue you," he said. "In the state of Florida, medical debt is treated just like any consumer debt. So, if they sue you and garnish your wages, now it affects your ability to pay back your mortgage. So, by not showing the clear picture to the mortgage company, you're kind of blind siding them.”

Sondi says there is something else behind the scenes that goes on with debt.

It’s often resold and even reclassified from medical into another category.

“They are going to resell it from one collection agency to another," he said. "So, it can still be shown on your credit report, like a collection account. Now you can dispute it, but it can take time.”

)