“I was lost,” Cross said. “That whole thing about helping others – now, I had to be able to get help for myself.”

Cross, the oldest of three sisters, says the sudden major life change was especially “catastrophic,” because she’d spent her whole life putting other people’s needs first. Now, at the age of 70, she finally had to learn to prioritize herself.

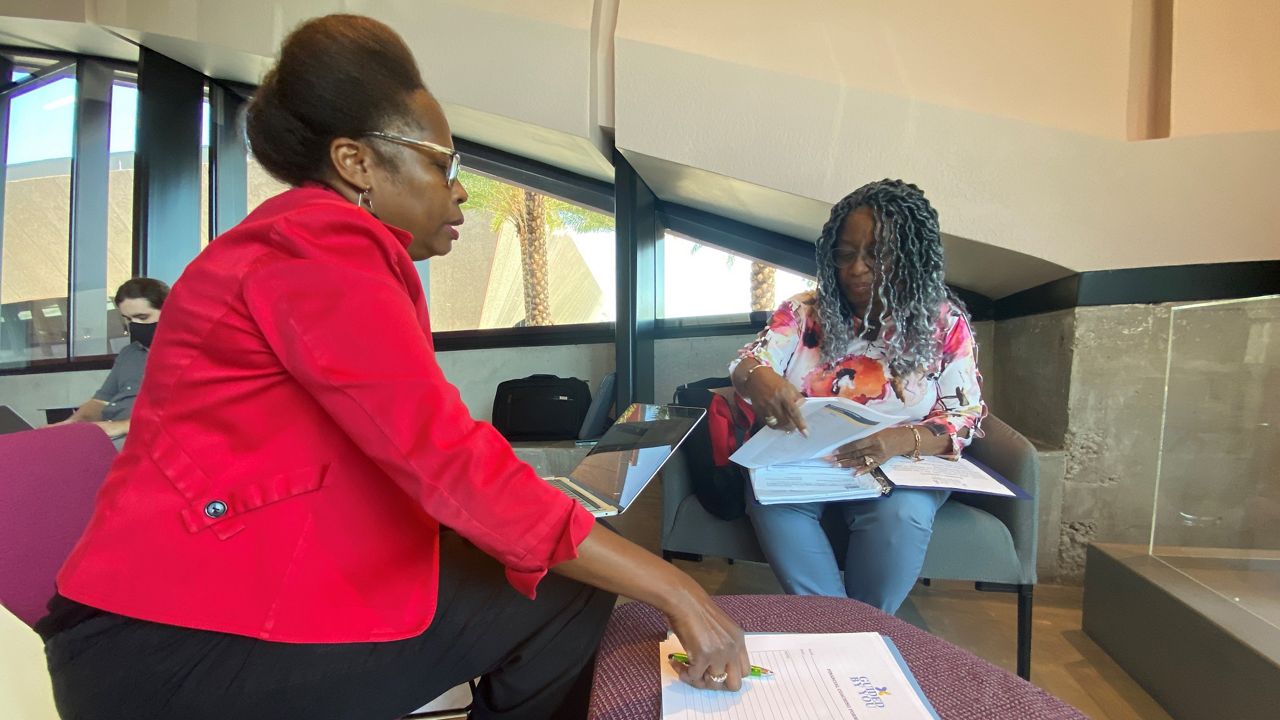

Cross says she has Denise Smalls, a financial coach, to thank for that. Smalls helps clients create and meet financial goals, file taxes and manage debt through her financial consulting company, Guided By You.

“She helps you find a way to make things happen, by looking at your expenses,” Cross said of Smalls. “When you start seeing how much you’re spending on entertainment, eating out – it makes a big difference.”

For Cross, the biggest initial challenge after her fiancé died was figuring out how to make ends meet with just one income. Smalls helped her downsize from a home to an apartment and find a part-time job. She’s also helped Cross start tracking her expenses – a foreign concept for many women, Smalls and other financial experts say.

“It is so rewarding to help women because historically, women have not learned about finances. They have depended on others to do the finances in the household,” Smalls said. “So my goal and my purpose is definitely to help them stand on their feet and … empower women, so that they’ll be able to be independent and financially wealthy.”

Ninety percent of her clients are women, Smalls said — and most of her female clients with kids are the primary breadwinners. Yet in many households, women still defer financial decisions to somebody else – usually the spouse, says Certified Financial Planner (CFP®) Nancy Hecht.

“For people like us, the female part of the equation, we’re always taught to take care of others first, and ourselves afterwards,” Hecht said. “However, if we do not fiscally or physically take care of ourselves, we are going to be absolutely no good to anybody else.”

That’s the lesson Cross is starting to learn now with help from Smalls, who also coaches Cross’s two sisters. Lisa, who’s 62, also started meeting with Cross after a major life change: when her ex-husband of 25 years suddenly left her for someone else.

“I just had to regroup and reevaluate my life without my husband, and that was a journey,” Lisa Cross said.

Since then, Lisa earned her bachelor’s degree — the same week she turned 50 – and is now working to build her first savings account. Fifty percent of women ages 55-66 don’t have any personal retirement savings, compared with 47% of men in the same age bracket, according to Census data.

Certainly, the financial struggle isn’t limited to women alone: right now, 64% of all Americans are living paycheck to paycheck, according to a recent LendingClub study. Besides today’s high inflation rates making just about everything more expensive, a lot of people living paycheck to paycheck may simply not be fully aware of their spending habits.

Women have come a long way, but still lag behind men financially – including when it comes to retirement savings.

— Molly Duerig (@mollyduerig) March 22, 2022

As Certified Financial Planner Nancy Hecht explains, that’s often bc women aren’t taught to prioritize themselves.

Learn more: https://t.co/JQ2CyeJSqD @MyNews13 pic.twitter.com/xdRJDeutkU

'Most people don’t keep a budget'

Smalls wanted her children to learn the importance of saving and budgeting early on, before the stakes were too high. When they were only about 12 or 13, Smalls says she gave them pretend credit cards to use.

“They were excited when I gave them their credit limit,” Smalls said. But then Smalls told her sons about the extra 18% interest rate they’d be responsible for paying, too.

“My son figured it out and was like, ‘Wait, I’m gonna pay you back — plus more money?!’” Smalls remembered. “There you go — that's the concept.”

Smalls’s kids picked up on financial skills early on, thanks to their mom – but it’s not something always taught in schools. That’s changing, though. State lawmakers just passed the Dorothy L. Hukill Financial Literacy Act, which will require public high school students to take a class in money management to graduate.

More people mindfully managing their money is something Hecht can get behind. Especially, she wants women to feel empowered to take more control of their finances.

“Women shouldn’t be afraid,” Hecht said. “Really, it’s just money. And yeah, it’s really, really important to our lives. But there’s no question that’s a bad question … Nobody should ever make you feel less than because you want to learn.”