When we began working on Uneven Odds: Chasing the American Dream, we set out to answer the question: how large of a racial/ethnic disparity exists for home loan applicants here in Central Florida? In other words, how likely is your race or ethnicity to affect your chances of getting a home loan?

Uneven Odds: Chasing the American Dream

- Understanding the Problem | Minorities still encounter obstacles on their path to the American Dream

- Facing the Hard Facts | As families struggle to achieve homeownership, data prove the disparities

- Searching for Real Solutions | Home loan inequality remains, but some people are making progress

To answer that question, Spectrum News 13 analyzed records for hundreds of thousands of mortgage loan applications that were submitted to Orlando-area lending institutions between 2018-2020. Under the Home Mortgage Disclosure Act (HMDA), the federal government is required to collect this data from certain lending institutions, including banks, credit unions and savings associations. The HMDA data is publicly available.

Spectrum News merged HMDA data with Census demographic information to create a new, unique dataset of loan application outcomes in relation to neighborhood diversity. From there, we narrowed our reporting scope, specifically examining the outcomes of loan applications submitted for first mortgages on single-family dwellings in the Orlando Metropolitan Statistical Area (MSA), which includes Orange, Osceola, Lake and Seminole counties.

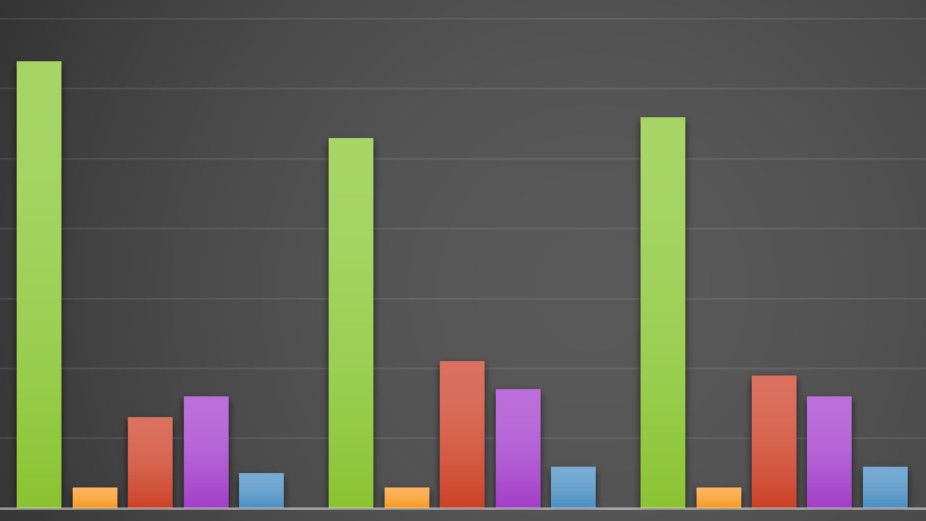

We found that between 2018-2020, Black loan applicants were denied at a higher rate than white applicants. Although Black applicants only made up 9% of all loan activity in the years we studied, they were responsible for 12% of all loan denials. Conversely, white applicants made up 46% of all loan activity — but just 37% of all denials.

Our analysis also revealed 63% of all white applicants got their loans, versus 53% of Black applicants and 56% of Hispanic or Latino applicants.

A final key finding from our analysis: in the Central Florida area, lenders put more money into majority-white neighborhoods than neighborhoods where people of color make up the majority.

As is true with any dataset, the numbers here help tell an important story — but they can’t tell us everything. They cannot, for instance, tell us how many people never feel prepared to apply for a home loan in the first place — a common theme we heard throughout our reporting. Numbers alone also can’t fully explain why an applicant is denied. Currently, HMDA does not publicly release applicants’ credit scores, a crucial scoring mechanism used by lenders.

It’s important to note that the different types of lending institutions represented in the HMDA data are held to different standards. Specifically, banks are federally mandated to follow fair lending laws and meet their communities’ credit needs in an equitable manner. Banks are monitored by federal regulators for their equitable lending efforts; other types of lending institutions, like credit unions and independent mortgage companies, are not. These types of “non-banks” now make up a majority of mortgage loans represented in HMDA’s dataset.

There are some ambiguous categories in HMDA data for race/ethnicity, like “joint” and “race not available,” and the numbers for those categories are often not insignificant. For example there were 76,902 “race not available” applicants. We can’t say who those people are, or how knowing their race/ethnicity might have changed our analysis.

In general, some ambiguity surrounds official definitions of race and ethnicity. Notably, the Census currently categorizes Hispanic/Latino as an ethnicity, not a race; this NPR article does a good job of explaining that confusion. For the purposes of our analysis, we classified Hispanic/Latino applicants as such, regardless of which “race” category they belong to. We classified white applicants as anybody who selected “white” for their race, and anything besides “Hispanic or Latino” for their ethnicity.

Spectrum News analyzed outcomes for white, Black, Hispanic/Latino and Asian applicants. These are the demographic groups with a significant number of records from which to draw. There weren’t enough applications to confidently analyze “American Indian or Alaska Native,” “Native Hawaiian or Other Pacific Islander.”

Other listed races not included are “2 or more minority races” or “Joint.”

Similarly, as with the “race not available” category, we simply don't know who these people are or how they may have changed our analysis.

Spectrum News ran multiple models to verify the findings detailed in Uneven Odds, and our work was also checked by data analysis experts from Investigative Reporters and Editors.

Statement from the American Bankers Association

“ABA firmly believes that discrimination has no place in the mortgage market. It is not just morally wrong but a violation of federal and state law. Banks in Orlando and across the country are in the business of making mortgage loans to creditworthy individuals, which is why they have every incentive to provide mortgages to those who qualify.

"We believe the HMDA data that underlies your story can help identify potential lending disparities within the mortgage market but given limitations with the data the numbers are not sufficient on their own to explain why those disparities exist. Any meaningful review of mortgage lending practices for possible discrimination, as regulators and the courts have made clear, must also consider individual factors such as a borrower’s credit score and credit history, which lenders are required by law to take into account. An individual's credit history can help explain why seemingly comparable applicants may not always end up with the same lending outcome.

“We share your concern that not everyone who wants a mortgage in this country may qualify under the current underwriting rules. The banking industry remains committed to working with all stakeholders to reduce the structural barriers standing in the way of those borrowers, so they can eventually get the opportunity to obtain a mortgage appropriate for them. Alongside civil rights organizations, consumer groups, and other industry trade associations, we successfully advocated last year for the CFPB to eliminate strict debt-to-income limits from mortgage rules, which we believe can help reduce lending disparity rates. We will continue to advocate for similar policy changes that can responsibly expand access to homeownership for more people in Orlando and across the nation."