The Consumer Financial Protection Bureau proposed a new rule Tuesday that would ban medical bills from credit reports.

The rule is intended to improve the credit scores of millions of Americans who struggle with medical debt, much of it as a result of medical emergencies.

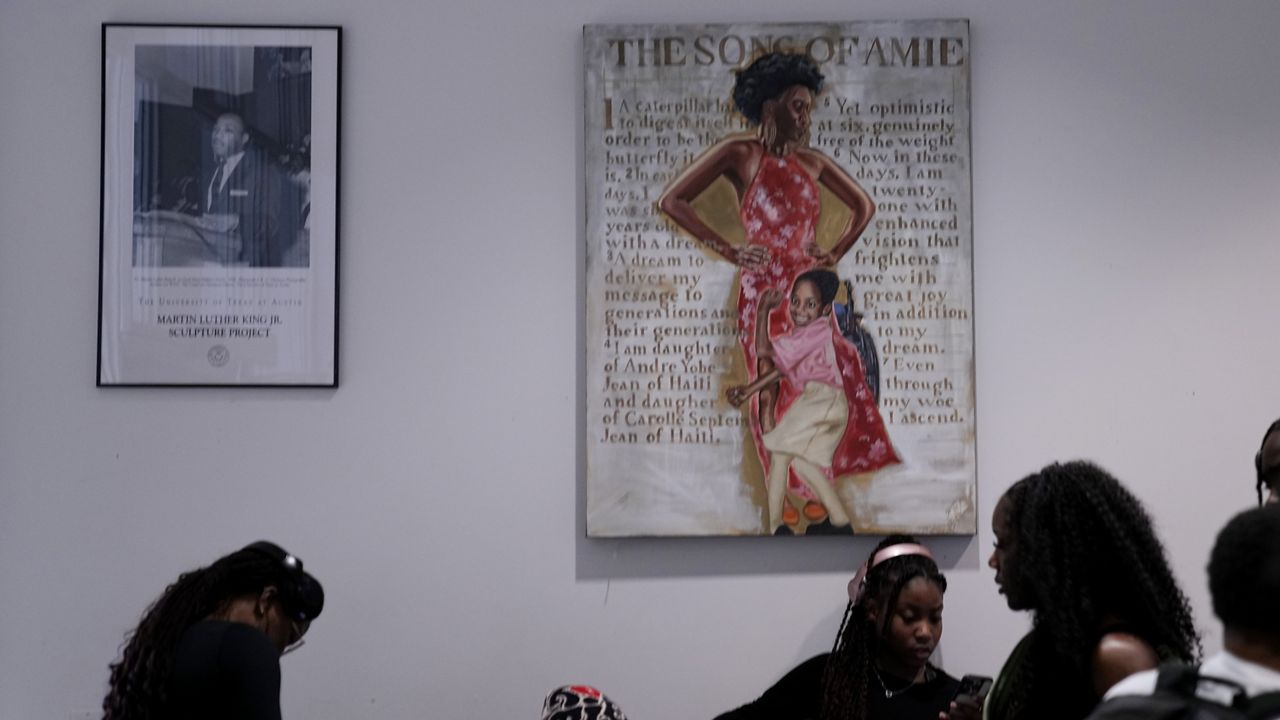

“The credit reporting system is intended to help lenders accurately assess whether someone is likely to pay back a loan,” CFPB Director Rohit Chopra said during an event announcing the proposed rule.

He said the majority of information on an individual’s credit report is from debt that consumers willingly signed up for, such as a mortgage or car loan. “But in recent years, medical bills have become the most common collection item on credit reports.”

He cited CFPB research from 2022 that showed medical collections appeared on 43 million credit reports; 58% of bills in collection on individuals’ credit reports were medical debts.

While consumers can expect their credit scores to be affected by mortgages, auto loans or credit cards they have initiated, medical debt, often from emergency room visits, is taken on unexpectedly and is also frequently subject to insurance coding errors, he said.

In addition to prohibiting medical debt from credit reports, the CFPB’s proposed rule is intended to prevent debt collectors from coercive payments and credit lenders from making decisions based on medical debt. It will also prevent lenders from taking wheelchairs, prosthetic limbs and other medical devices as collateral for a loan.

“Medical debt makes it more difficult for millions of Americans to be approved for a car, home or small business loan, all of which makes it more difficult to get by, much less get ahead,” Vice President Kamala Harris said at the event.

The vice president said about 3 million Americans are benefiting from $7 billion in American Rescue Plan funds to eliminate their medical debt. She called on states and local governments to join the Biden administration in reducing consumers’ medical debt by expanding access to charity care and using public funds to help individuals get rid of debt from medical procedures.

Citing CFPB research, the vice president said, “People with medical debt are no less likely to repay a loan than people without medical debt.”

In 2022, the CFPB estimated that $88 billion in medical debt was listed on credit reports. In response, the three national credit reporting agencies (Equifax, Experian and TransUnion) said they would remove many medical bills from their reports.

Even so, 15 million Americans have $49 billion in outstanding medical debt in collections that are reflected in their credit reports.

“The Nationwide Consumer Reporting Agencies understand the important role we play in the financial lives of Americans, and we remain committed to helping facilitate fair and affordable access to credit for all consumers,” a spokesperson for the Consumer Data Industry Assn. told Spectrum News. “We are reviewing the CFPB’s Notice of Proposed Rulemaking in full detail and look forward to the opportunity to discussing it with the CFPB.”

The CFPB said 22,000 more American families will be approved for mortgages once the rule is finalized. It expects the average credit score to increase 20 points as a result of the rule change.

The CFPB is accepting comments from the public through August 12 and expects to finalize the proposed rule in early 2025.